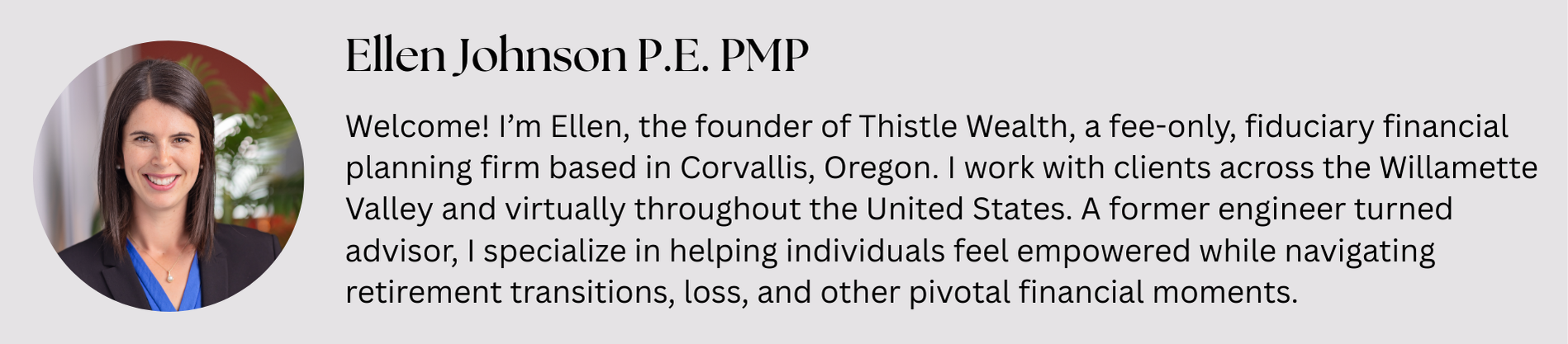

Getting to Know Ellen Johnson, Founder of Thistle Wealth

At Thistle Wealth, I work with people in transition—whether they're entering retirement, reevaluating their next chapter, or balancing careers and family life. Many of my clients are women, but not all. What they all share is a desire to align their money with their values and move forward with confidence. In this Q&A, I’m sharing more about my background, why I love this work, and how I define financial success for myself and my clients.

Q: What is the biggest misconception about your job?

That we use the same playbook for everyone. In truth, each client brings a distinct set of goals, challenges, and circumstances. The part I enjoy most is crafting a strategy that’s completely tailored—because no two lives, and no two plans, are the same. As someone who loves solving puzzles, I find deep fulfillment in building something unique with every client.

Q: What makes you particularly qualified to serve individuals in or near retirement, STEM professionals, or dual-income families?

My personal and professional path mirrors many of the transitions my clients face. I spent over a decade as a mechanical engineer, designing food processing facilities for companies like Tillamook and Kettle Chips. Eventually, I founded and led my own consulting firm—experiences that taught me how to lead in complex, technical environments often dominated by men.

Later, I made a bold career shift. There was a period where I had no job title—just a clear intention to build a life aligned with my evolving values. That time of reinvention helps me relate deeply to clients approaching retirement or reevaluating their next steps. I know what it feels like to design a future from scratch—one that reflects who you are today, not who you once were.

My husband (also a former engineer) and I now run our own businesses while raising two young daughters and staying involved in our Corvallis community. Because I’ve lived the juggle of career, family, and long-term planning, I bring not just technical skill, but empathy and real-world perspective to every client engagement.

Q: Why did you choose to be a fee-only advisor?

Choosing to be a fee-only advisor was a foundational decision for me. It means I work solely for my clients—not for product providers or outside interests. I don’t receive commissions or third-party incentives. Instead, my compensation comes directly from the people I serve, creating a relationship that’s fully transparent and aligned.

That clarity allows me to focus entirely on what’s best for you. You can trust that every recommendation comes from a place of care, intention, and an honest understanding of your goals.

Q: What part of your work gives you the most satisfaction?

The most rewarding moments are when a client begins to feel a shift—from stress or uncertainty to calm and clarity. Often it starts with a simple conversation, and gradually, we build a plan that truly reflects their life, goals, and values.

Financial planning should ease your mind, not add to your worries. Seeing someone feel lighter, more in control, and free to focus on what matters most—that’s what drives me.

Q: What inspired your love of financial planning and wealth management?

Financial independence was a core value in my family. My mom passed that on to me after seeing her aunt struggle through a sudden and unprepared widowhood. Left with a wheat ranch and a business to manage, her aunt didn’t have the tools or confidence to take control. She couldn’t even write the check to reimburse my mom for funeral flowers—and eventually, she remarried not for love, but for financial survival.

That story shaped my perspective from a young age. I never wanted to feel that vulnerable—and I wanted others to have more options, more support, and more knowledge. That’s what led me to create Thistle Wealth: a place where clients feel empowered to make informed, confident decisions about their future.

Q: What does financial success mean to you?

To me, it’s about peace of mind. A successful financial plan doesn’t dominate your thoughts—it runs quietly in the background, helping you make steady progress while you live your life.

When your finances are aligned with your priorities, you gain the freedom to focus on what really matters—your family, your passions, and your personal sense of purpose.

Q: Is there a particular book that has had a positive influence on your personal or professional life?

Absolutely—The Good Life by Robert Waldinger. His research reinforces a powerful truth: our happiness isn’t built on wealth or status, but on the strength of our relationships. If money stress is taking up all our mental space, it limits our ability to be present for those connections.

Helping clients reduce financial anxiety is my small contribution to creating more joy and connection in the world.

Q: How are you involved in your community?

I serve as the Pro Bono Director for the Oregon/Washington chapter of the Financial Planning Association (FPA), helping expand access to quality financial guidance. I also volunteer on the board at my daughter’s school—because building strong communities starts with investing in the next generation.